For us left in MI, here’s some sobering stats and realities. Per the Wall Street Journal:

“Between 1980 and 2011, total employment in right-to-work states grew by 71%, .. in non-right-to-work states … 32%. .. in Michigan … 14% during that time…. inflation-adjusted compensation grew 12% in right-to-work states, but just 3% in the others….

…the bill he signed into law on Tuesday is “pro-worker,” …does not change any aspect of collective bargaining other than preventing employees from getting fired for choosing not to join or remain in a union and pay union dues or agency fees, which may go toward political causes they don’t support. Options are of course part of the reason America was formed, in contrast with communist & socialist economies.

The good news ? MI just became a RTW state – as such, we are now in competition for importing businesses & workers to fill new jobs. This should bring buyers where we’ve had sellers for so long. Those that are against this new law I can’t really agree with, to wit: “Collective bargaining still exists … workers are of course free to organize….”

[MI is the only state to loose population in the last 10 yrs…. the statistics go on and are overwhelming in their conclusion ….so what is this guy thinking >] “…Democratic Rep. Doug Geiss threatened: “There will be blood. . . . There will be repercussions.”

http://online.wsj.com/article/SB10001424127887323981504578175263199214992.html

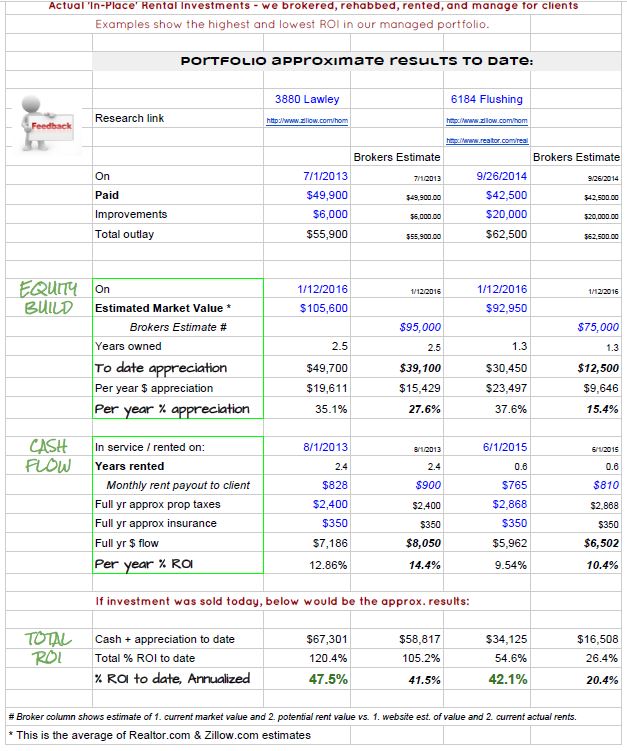

estate investment ? Well here are actual numbers of the highest and lowest producing properties that we’ve set up and mange for active client portfolios.

estate investment ? Well here are actual numbers of the highest and lowest producing properties that we’ve set up and mange for active client portfolios.

![Taking-Responsibility-and-Managing-Debt-Image-4[1]](https://realtynetworth.com/wp-content/uploads/2015/12/taking-responsibility-and-managing-debt-image-41.jpg?w=748)

get data feeds directly from brokers and MLSs because, without a direct feed, the portals face accuracy and timeliness issues with the listing data they get from a variety of sources.

get data feeds directly from brokers and MLSs because, without a direct feed, the portals face accuracy and timeliness issues with the listing data they get from a variety of sources.![faqs2-300x225[1]](https://realtynetworth.com/wp-content/uploads/2012/10/faqs2-300x2251.jpg?w=185&h=139)

homestead. Homeowners can transfer their SOH benefit to a new home if they had the homestead exemption on the old home in either of the previous two years.

homestead. Homeowners can transfer their SOH benefit to a new home if they had the homestead exemption on the old home in either of the previous two years.